The End Isn't Nigh? A Look at the Triple-A Gaming Shares Slump

by on 8th Feb 2019 in News

Over the past days and weeks, a number of the global games industry's major triple-A publishers have seen share prices drop as finical results have come in.

Electronic Arts (EA), which this week saw its Fortnite challenger Apex Legends enjoy a stellar launch, saw its share price fall by a peak of 19%, with Bloomberg identifying disappointing sales of the first-person shooter Battlefield V.

As highlighted by Bloomberg, EA's adjusted revenue is expected to come in at USD$1.17bn (£902m) for the quarter ending this march; somewhat lover than the average USD$1.47bn (£1.13bn) predicted by market analysts. Meanwhile, net revenue of EA's physical products fell 15% to USD$1.55bn (£1.19bn) in the 12 months of 2018.

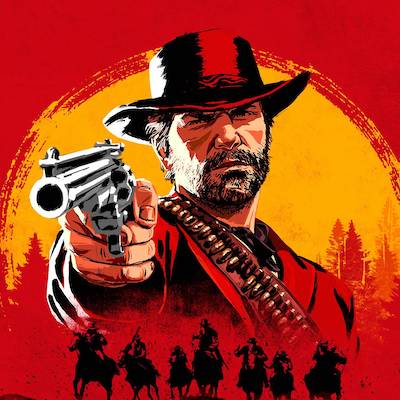

Red Dead Redmeption 2 publisher Take-Two Interactive, meanwhile, in recent days reported expected revenues of USD$450-500m (£342-424m) for the same quarter; someway below the expected USD$609.1m (£470m), as reported by a separate piece on Bloomberg. Shares dropped 14% as a result. That's despite the remarkable popularity of their hit western game.

Activision Blizzard and Ubisoft have also seen share prices fall in recent days.

The previous week, as reported by the Financial Times, saw Nintendo shares dip 9.2% in a single day. Meanwhile, PlayStation maker Sony has seen its share price climb a little, but only after offering a share buy-back in response to an earlier 14% share dip.

Disappointing sales of Battlefield V have been highlighted as contributing to EA's share price downturn

All of this recent activity in a little more than a week makes it pretty easy to assert that triple-A, traditional, and console gaming is in trouble. But is that really the case?

Fortnite, of course, is taking some of the blame for the apparent downturn, and it probably has much to answer for. A celebrated free-to-play shooter offering near infinite replay value is likely to be more appealing to many of the game-buying public than a traditional £50 triple-A shooter.

But Fortnite itself is thriving on console. And EA might be proving taking a little back is possible with Apex Legends.

The fact is, thanks to video games' existence as a technological entity, rapid progress, advance, and change are always going to be core to any definition of the medium and its ecosystems. Video game markets have always been volatile; and the industry itself has weathered many storms, and even flips from boom to bust. Famously, it is relatively resilient to recession, at least with regard to unit sales.

Today, both the medium and the platforms that host games are diversifying rapidly. That brings many challenges, but it also highlights a key point. While game business trends can be meaningfully tracked, change and disruption are all part of a regular 12-months for games. In the past 15 years alone, we have had the casual boom, the arrival of smartphone gaming, free-to-play's reinvention of how games are designed and consumed, the rise of online multiplayer and esports, the return of PC gaming, the indie renaissance, the establishment of the online download store, endless hype around VR/AR, the debut of significant consumer crowdfunding, the battle royale phenomenon, and more. And so often such movements are heralded as the end of traditional gaming on console and PC.

There have been tough times; and we may be seeing the end of handheld gaming drawing in, but triple-A has continued to sell well, court attention, spearhead design trends, define hardware, and found many industry ecosystems, technologies, and services.

Times may currently be tough for some of the world's biggest publishers, and the opening days of February 2019 could reasonably be framed as a 'flop' for triple-A.

But there is plenty of February to go and, in that short time alone, anything could happen in the business of games.

As Berenberg analyst Robert Berg put it in a report quoted by Bloomberg: “We believe that recent share price performances and current valuation multiples suggest structural uncertainty, which to us is far from the reality. In fact, the video game segment is in rude health.”

Activision BlizzardAudienceesportsGamingMobileMonetisationMultiplayerPlayersPublisherTechnology

Follow TheGamingEconomy